Introduction

This blog is continuation from what I wrote previously:

For more detailed analysis on business model and products, following may be worth a read

After a brief surge in SP from around $10 to $27( $2.4B market cap) from May-July 2023, Opera stock price crashed back into low $10’s after a SEC filing by majority holder, Yahui Zhao and Kunlun tech to sell stock. None of the business fundamentals changed to warrant such a sharp drop back into criminally undervalued valuation but it did. Yahui ending up selling about 7M of ADS at fire-sale valuation of $11.75 when in fact he and Opera has been buying back ADS around $14 in previous quarter. I still can not understand what warranted this move to sell-at-all-cost-at-fire-sale price by Yahui Zhao, but later, it allowed Opera to take advantage of these fire-sale price to complete its previously announced $50M share buyback in Q4’24. Since that initial sale in Oct’23, Yahui has not sold anymore despite the stock sitting at FY24 high’s now.

Despite hitting FY24 high’s recently, I still think that Opera is very undervalued.

Market Cap: ~1.8B

Cash and cash equivalent : $106M

Opay 9.4% stake : $253M

Opera Core= $1.8B - $106M - $253M = $1441M

Opera GM = 75%

Opera was operating in 90%+ GM before it started selling inventory for its partners with its ad network which carries around 10% GM. Now it is seeing acceleration in ad revenue growth in its own inventory which carries 90%+ GM, so overall GM should improve if this trend continues.

Opera's AEBITDA Goal = 25%-30% of revenue

Opera is still investing for growth and I expect this theme to continue in FY‘25.

Opera FY' 24 Forecast(high end) - $473M revenue, $114M AEBITDA and I expect it to guide for 15% growth($544M) in FY25 with 25% AEBITDA margin($136M)

Currently trading at ~2.6x my FY’25 est. revenue and ~10x est. AEBITDA.

Opera has been hit by strong USD in last couple of years. Its Q3’24 revenue grew at 26% at FX-neutral basis.

Opera has $0.80 Annual dividend with a yield of 4% at $20.

2024 Recap:

Google exercised its right to extend the search agreement through FY25 on existing terms. When the last agreement was signed, Opera had around 38M western users and now it has 51M. Also, GX was in early stages and now with a very targeted audience of 30M+ GX users and DMA tailwind, I think Opera has potential to get a 20% better take rate than its current agreement. Currently Opera makes about $150M annual revenue from search with majority being from Google. For comparison, Firefox makes $550M annual revenue from Google, so Opera has huge opportunity to increases its search revenue here by negotiating higher take rate when it renew its search agreement with Google Mid 2025.

Opera invested into an AI cluster at $19M capex. I think this expensive GPU capacity is under-utilized and Opera should have waited to see traction in its AI offering before making such investment. I do hope that if Opera is loaning this free capacity to one of the other kunlun subsidiaries( for example, skywork PTE), it is getting compensated for it. I do understand the rationale here that owning the GPU cluster would be lot cheaper in the long run than getting it from cloud provider as long as Opera has found a way to effectively utilize it or lease it when under-utilized.

DMA coming into effect and Opera is gaining organic users across both android and iOS. Opera and other browser makers have filed a complaint to include Microsoft edge as gatekeeper. I think the later is a big deal as Microsoft is able to move back users from Opera to Edge with its deceptive tactics as filed in the complaint and this could be the reason that Opera’s western user base in desktop is stagnating around $50M users.

Opera has refreshed its browser with many differentiated features in both its flagship and Opera GX and it has one of the best product portfolio ever and this explains the higher spend on marketing to gain more users.

Opera has always been very conservative in sharing its internal revenue/growth targets. But For the first time ever, Opera has stated a 10x-20x of growth potential in its Q2’24 earnings call.

Similarly, they called out 10x potential in growth of Opera GX users.

Even achieving a modest 2x in revenue at 15% CAGR in next 4-5 years would have an outsized impact on Opera’s valuation.

Opera also has got some traction with its minipay feature and now standalone app with 2M users, but it won’t be a major revenue driver but it may helps with stickiness of its products with cross-selling opportunities.

Opera seems to have given up on its cashback/shopping corner initiative. Most of the link for deals in shopping corner has been broken for months anyway. I think this is a missed opportunity and Opera should have been able to better monetize the cashback and shopping story specially amongst the women shoppers.

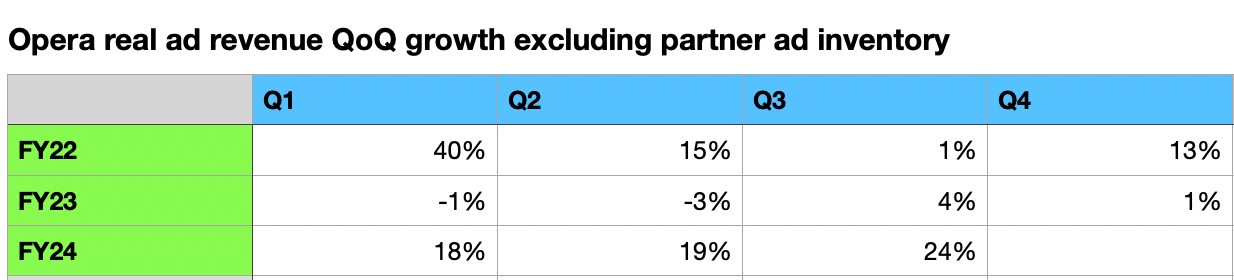

One important detail which got lost in Opera’s FY24 financial numbers is the acceleration of q-o-q advertising revenue growth in its owned properties. *I think* these comes at 90%+ gross margin compared to around 10% margin for partner inventory. Opera is able to monetize its own Opera, Opera GX, Opera News and Opera Mini inventory better but it could also be the reflection of engagement metrics of its products. More hours spent in its browsers leads to more ad impressions/clicks and thus higher revenue. I wish Opera start sharing daily active users or some other engagement metrics instead of MAU. I find Opera’s MAU numbers less meaningful and partially misleading as it is organically losing its feature phone users and with less focus on getting Opera pre-installed in mobile phones in Africa/Asia, it will lose some MAU which are one time users and contribute very little to revenue if any.

Assuming 10% take rate on cost of inventory, Opera’s ad revenue on its own ad inventory is seeing growth acceleration. If the take rate is less than 10%, then the acceleration would be even higher than below:

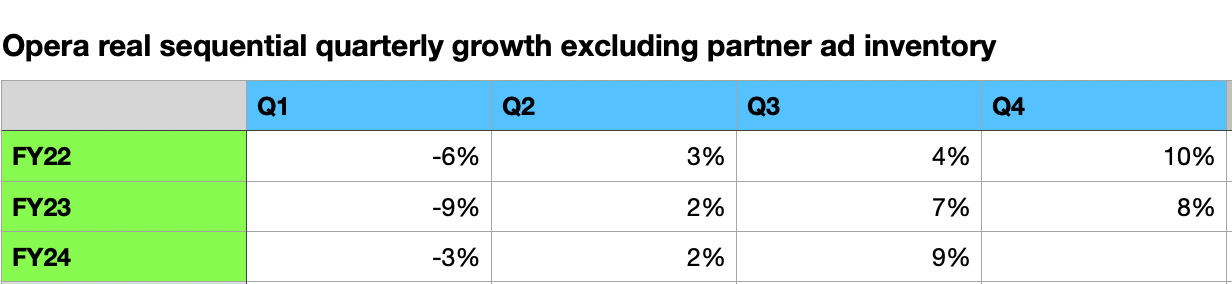

Similarly, Opera’s sequential quarterly growth rate is also seeing acceleration.

Based on Opera’s Q4’24 forecast, both above metrics would see the continuation of that acceleration when Opera report its Q4’24 earnings.

What to Expect in 2025

Opera will again guide conservatively for FY’25 when they report FY’24 numbers. For FY’24, I expect Opera to report ~$473M revenue and ~$115M AEBITDA with ~24% AEBITDA margin. This will break the streak of 20%+ revenue growth as law of large number finally catches to Opera. However, I do expect Opera to meet the “Rule of 40” (Rev growth + AEBITDA margin) criteria, Which I first mentioned in my tweet in Feb 2023 , for many more years.

For FY25, I expect it to guide to 15% growth($544M) and 25% AEBITDA margin($136M). Like FY24, as the year progresses, I expect Opera to raise guidance and will end around 17% growth at 26% AEBITDA margin.

I expect few more sell-side analyst initiate coverage of OPRA

Potential Opay IPO at $4-5B valuation would increase its cash position significantly and possibly another special dividend in FY25.

I do expect stock price to trade around $3B valuation range most of FY25 unless geo-political tension and/or tariff war’s bring US and world economy into recession. I caution readers to take my forecast with ample grain of salt, and do their own due diligence, as I have been saying the same for last couple of years and market has been disagreeing with me.

Opera is also working on monetization options and engagement growth for its gx.games portal which could also bring more game developers into it. Few hit games can have material impact from revenue perspective but it is a long shot.

Some catalyst in 2025 could be

Renewal of google search agreement with higher take rate

European commission designate Microsoft Edge as gatekeeper

Better monetization of the prime browser real estate with AI based offerings

Opay IPO

Further tailwind from DMA and acceleration in western user growth

My wishlist ( or rather continuation) in FY25 would be:

Marketing deal with Oprah to increase brand awareness in US. Opera has 34% brand awareness in US compared to 56% in Germany and that is a huge opportunity to increase awareness with celebrity endorsement.

Super bowl ad ??? …Temu and Shein have done it to good effect and why not ? - Opera has $120M+ annual marketing budget.

A western CEO with Song Lin transitioning to a president/COO role.

Disclosure

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

This is NOT an investment advice/recommendations. I am not a financial advisor. Do your own Due Diligence if you decide to trade/invest into OPRA.

Hi Bryce. My name is Roni. Really enjoyed reading your posts.

It would be nice if you unblocked me on Twitter (username @NatbagN). I think you did it because I told someone I'm shorting $opra but I was trolling him, and I'm actually long the stock.

I was wondering: what is your market cap estimate for MiniPay? 0.5B$ ? More than that?

I'm trying to calculate Opera's fair price, and this is the only missing detail