Opera Stock is Primed for Upside Parabolic Move

Introduction

Since 2018 Opera’s revenue has almost doubled, its minority stakes continue to grow like wildfire, and its cash and cash equivalents have increased to ~$200M. This has also coincided with 2 stock buybacks and continued investments in minority stakes. Despite these achievements the market has still decided to pay no notice, with the company continuing to hover around a $1 Billion market cap.

There is reason to think this is about to change, with Opera’s price to soon start reflecting the facts. Growth is healthy, with the 50% revenue growth expected this year taking total revenue to $247M for 2021. Though, more important is where this growth is coming from.

With valuations in the gaming and fintech sectors becoming steep, investors are bound to soon uncover the fact that Opera is enjoying this growth from its fintech and gaming assets. Opera’s fintech and gaming assets, in contrast with current market darlings, are currently trading at depressed valuation given the company’s current valuation. This report will highlight how this is bound to change, providing upward pressure on Opera’s share price in the process.

For those not familiar with Opera’s massively undervalued story, growth opportunities and upcoming catalysts, can read my analysis on its business model and Sum-of-the-Part valuation here.

Opera’s short interest and float does not give the impression of OPRA as a classic short squeeze candidate, but once you peel the layers as I covered in this analysis, with slightest increase in volume to ~500k shares will trigger buy signals to algorithms, large # of hedge funds chasing momentum will jump into it, the move in OPRA’s share will be swift given most institutions are still in accumulation mode and not much float available to buy.

Why I think it has all pieces now to go parabolic

Strong Growth in Core: Opera has 3 successive quarterly results where it has beaten the expectations and has raised the FY’21 guidance 3 times in a row.Since going public, It also had the largest sequential increase in revenue of 17% Q2 ‘21. In short, Opera business has come out stronger out of covid with 48% increase in revenue compared to pre-covid and is investing into growth which will allow it to continue to grow at the high end of 20-30% growth target Opera management has set for next few years. If any of its new initiatives in fintech(Dify) and Gaming(YoYo Games) see moderate success, Opera should handily beat the high end of 30% revenue growth target and can grow 30-40% for next 2 years.

Hockey stick growth in Minority stake valuation: Opera’s minority stakes in Opay and Starmaker have been growing at between 250% and 350% and recently Opay announced $400M funding at a $2B valuation. Opera’s ~8% and 19.4% stake in these have grown 4x in the last year. Opera’s other investee, Nanobank, where it has 42% stake is halfway in its path from covid related slowdown but it offers most upside once it reaches its pre-covid revenue run rate of $120M sometime in H1 ‘22. When valued appropriately, together these minority stakes and cash/equivalents now make up the entire $1B market cap and some can argue that these stakes would again double in the next 1-2 year.

Hedge fund Visibility: It has caught the eyes of many hedge funds in the last 2 quarters which have been slowly accumulating and building their positions.

Since going public in 2018, Opera has gotten very little investor coverage and was even a target of a flimsy short report in Jan 2020 which I believe was to shake and keep retail investors out (with benefit of time on my side, this is my rebuttal to that short report) . Up until now, it has not gotten the attention of hedge funds and large institutions, which started changing in Q1 ‘21. Several new hedge funds made new investments in Opera in Q1 2021, which probably was the reason for the jump in share price from $9 to $14 in a span of 10 days in Feb ’21.

Here is snapshot of Q1 ‘21 institutional holdings:

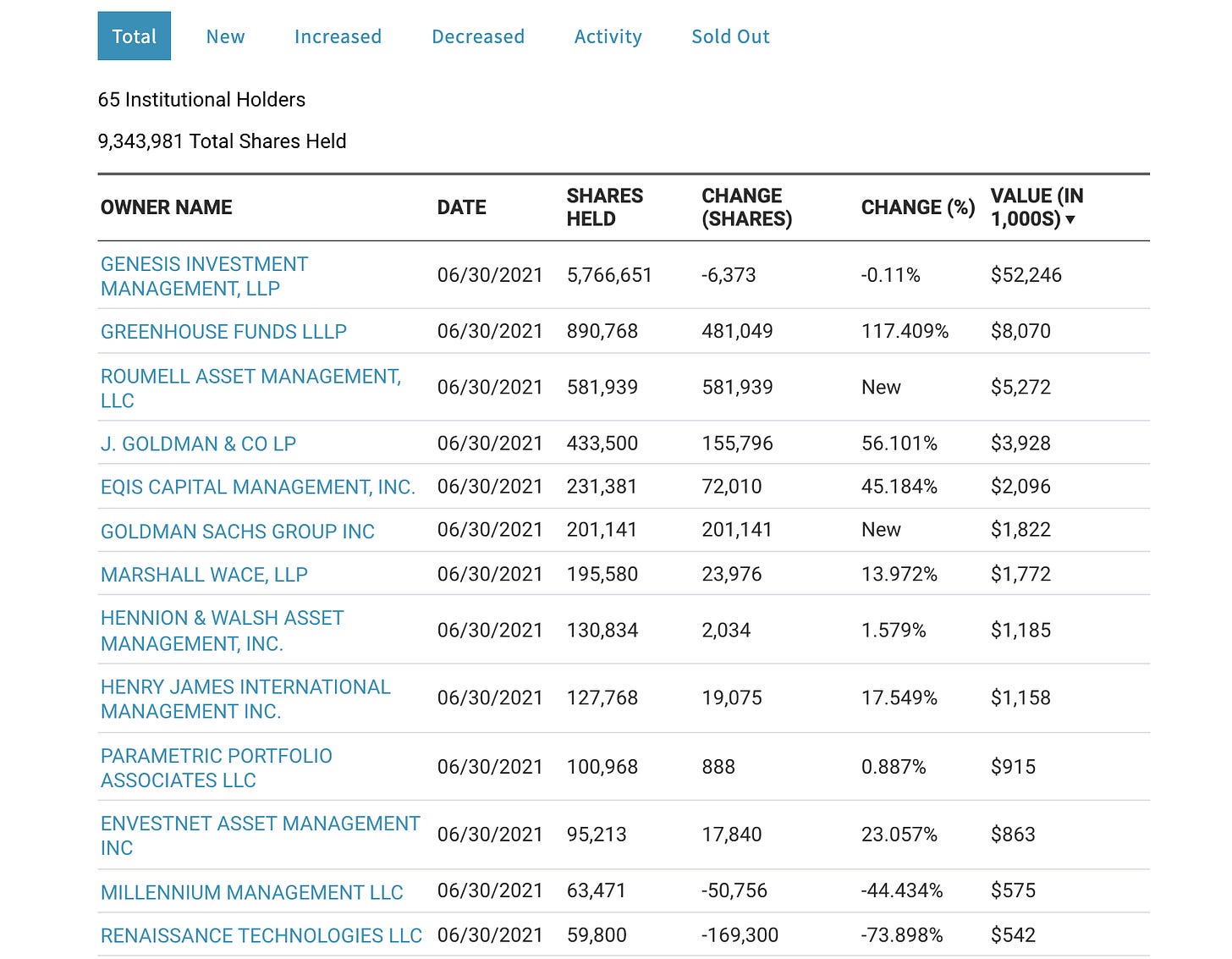

With the exception of Toroso which made OPRA part of block chain ETF $BLOK in Q4 ‘20 but sold all of its stake in June 2020, all other top holding hedge funds and institutions have added to their Opera position significantly. Here is a snapshot of institutional holding at the end of Q2 ‘21.

Top Hedge Funds still adding to position: As per latest Q2 ‘20 13-F filings, Greenhouse, Roumell, J Goldman , Eqis have significantly added to their OPRA position in Q2. This shows the confidence these hedge funds have in OPRA. Roumell recently came out publicly in support of OPRA calling it one of their top holdings and its ultra conservative SOTP valuation of Opera put them at $16, which in my opinion is fire sale price of OPRA.

Rising Short Interest: As retail investor sentiment is warming up to OPRA, its short interest is going up.

Limited Share Availability: Despite all the top holders adding significantly to their position in Q2 ‘21, the overall institution holding barely changed from 9.3 million in Q1 ‘21. This shows that whatever small quantity retail and other smaller hedge funds hold, they are not selling.

Top 7 Institutional Holding: The top 7 holders hold around 8 million out of 9.3M ADS in float by institutions. These funds have been holding steady or buying as of Q2. If we take their holding out assuming they are still building their position, only 1.3M ADS is available from other funds to sell. Now put this 1.3M in the context of around 580K shares short. This is why I think Opera is candidate for stealth mode short squeeze.

What does Opera needs for it to go Parabolic

Knowing how mis-priced Opera is due to limited sell side coverage, the only thing which is stopping Opera from having a large upside parabolic move into the 30's is 3 V's.

Volume: Opera trades around 40k to 100k shares on average. Some hedge funds have volume requirements, and talking to some other fellow investors, it looks like they will build a position only after Opera trades 300-500k shares on average. This is a chicken and egg problem since all current holders are not selling knowing how undervalued the stock is. Once Opera starts trading in the 20's, some hedge funds/retail investors may consider it fairly valued and may start trading some part of their position and bring in volume.

Visibility: Despite presenting in many investor conferences, Opera has not gotten coverage from any renowned firm. Again it is a chicken and egg problem as they do not see enough liquidity and trading volume for a viable profit path from Opera coverage.

Volatility: Since Opera has been in slow accumulation mode from many hedge funds, Opera does not have any real volatility. Market makers take Opera down 10’s on cents on a few hundred dollar sale but also take it up by 30-50 cents on even a thousand share buy. This is again a chicken and egg problem where lack of volume and visibility allows market makers to control the direction of stock price movement.

To find if there is any solution to the chicken and egg problem of 3 V’s, let's first take a look at ownership of around 116M ADS and float.

This is where it gets interesting now.

Out of a total float of around 15M ADS, institutions own around 14M ADS. Very little float of less than 1 million ADS is owned by retail(myself included) and smaller hedge funds of around 1M.

With the exception of Toroso, none of the institutions which hold a significant OPRA stake starting Q4’20 to Q2 ’21 has meaningfully decreased their position. In fact, they have added to it or kept it largely unchanged.

If we assume(and agree) the current 15M float is held by investors with a longer term view and they all believe in this massive valuation disconnect, and these institutions and retail continue to hold, or add to their position until stock gets into 30’s, with just a tiny bit of retail and/or hedge funds interest, the ~580k share short position will come under pressure very quickly.

With ~580k shares short and average volume of ~40k and SP at ~$9, imagine what can happen, if a couple of hedge funds who have done their research and see this massive valuation disconnect, try to initiate a 500k position or lets say 1000 retail investor trying to buy 1000 shares each at price between $9 and $12 ?

I think it will cause the SP to go parabolic into the high 20’s/low 30’s in a matter of a few days or at most a couple of week’s. Once OPRA goes over $15.67, all time high, I think it will bring attention from the larger investment community, institutions and buy side and sell side analysts. This will bring more buyers and hence quicker appreciation in SP fueling the parabolic move.

Most importantly, I think Opera's parabolic move into the 30’s will not be the pump and dump type of parabolic move, which is typically short lived, like we have seen with MRIN or NEGG. It will, in fact, unlock the true value of Opera and bring in volume and visibility, and would create a strong base for Opera before the next round of upward moves depending on how its new initiatives in fintech and gaming progresses and how fast its minority stakes continue to grow.

With many catalyst on horizon, ~50% YoY revenue growth, hockey stick growth in its minority investments in Opay and Starmaker and new fintech and gaming initiatives, I think, conservatively, Opera is on the path to highly profitable $300-$325m revenue run rate next year and smart money knows that, and hence are all these shenanigans to keep the retail out with short attacks, low balled price targets from sell-side analyst, stagnated stock price action despite excellent earning results and if everything fail, fear mongering of 80% Chinese Ownership. Any investor who does proper due diligence, hopefully should be able to see the bluff and see true value of Opera, at the very least around $35-$40, like I do.

Disclosure/Disclaimer : ***This is not investment advice or recommendation to buy OPRA stock. Do your own DD on OPRA and let me know if you agree/disagree with my thesis and/or have contrarian views .I own OPRA shares.